Nowadays, we are seeing a greater emphasis on regular exercises and fitness, with gyms and studios readily available everywhere. Being fit makes us to feel good emotionally and physically, plus we get healthier and more energetic!

Just like how physical fitness is a key component of overall health, Financial Fitness plays a vital key role in our financial health and well-being. When we are financially fit, we will feel less stressful over our finances, and have more confidence in our future.

So what is Financial Fitness?

Financial Fitness consists of 3 Key Metrics – Cash Flow, Net Worth and Risk Management.

These 3 metrics are akin to common physical fitness metrics of Cardiovascular Health, Muscular Strength and Flexibility.

This post will focus on the first metric of Financial Fitness – Cash Flow. Check out the other 2 metrics here

#1 Cash Flow

#1 Cash Flow

Cash flow is like oxygen flow to the body. Just like how we get breathless and giddy when there’s a poor flow of oxygen, similarly we get into financial stress and difficulties when we experience problems with our cash flow e.g living from paycheck to paycheck and chalking up debts from overspending.

Cash Flow is about the flow of money in and out of your accounts.

- Cash Inflows generally include salaries, interest from savings accounts, dividends from investments, profits from the sale of stocks and bonds etc

- Cash Outflows represents all expenses such as rent or mortgage/loan payments, utility bills, groceries, transportation, entertainment etc

When Cash Inflow > Cash Outflow, it means you have a Net Positive (+ve) Cashflow which is a healthy sign and vice versa.

Cultivating good financial management habits is like working out your cardiovascular system so you have a healthy oxygen flow throughout your body.

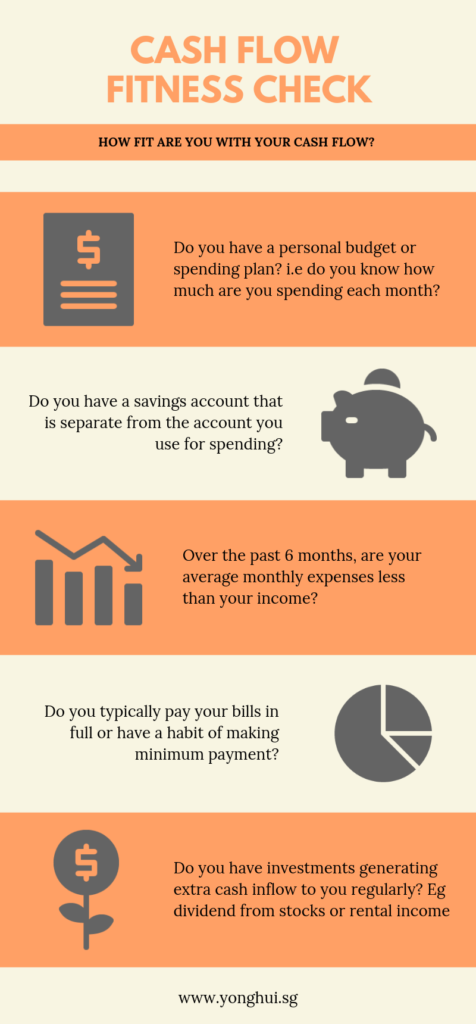

Let’s do a quick Cash Flow fitness check:

If your answers to the above questions are mostly Yes, then congratulations you have healthy cash flow fitness!

If no, fret not, here are some tips to help!

How to UP your Financial Fitness?

1. Be conscious of your spending

First, be aware of how much and where you are spending on. We know it can be tempting to spend on things we want but don’t really need, especially with plenty of online shopping apps nowadays. But a little here and there adds up overtime and without tracking you may find that your money seems to “mysteriously disappear”, resulting with little savings at the end of the day. You can download money tracking apps like Spendee or Wallet to track your expenses so you have a clearer picture of where your money goes.

2. Adopt the 50/30/20 budgeting rule

This is a simple budgeting rule that allows you to have a balanced life without compromising on saving for the future.

- 50% on Necessities like mortgage, transportation, utilities, groceries and insurance.

- 20% on Savings for financial priorities like retirement, children’s education and debt repayment

- 30% on Wants & Lifestyle like cable, internet and phone plans, charitable giving, entertainment, hobbies, personal care, restaurants, shopping and other miscellaneous expenses.

3. Save for the future

Automate your savings by channeling a portion (rule of thumb – 20%) of your income to a savings account every month.

4. Only borrow what you can afford

Don’t restrict yourself, but avoid spending for an outward show or status symbol. Consider the loss to your long-term goals when you choose to spend now. Avoid chalking up credit up loans as the interest accumulates at extremely high rates.

5. Increase your cash inflows by investing in instruments that generate passive income

Cashflow game is a great way to learn how to build up extra cashflow through investments without risking your real money. Plus you’ll get to take home practical financial management skills after a fun experiential game. Sounds good? Join us at the next cash flow game here!

I hope you have enjoyed this article and found the tips useful! Check out the other 2 metrics of Financial Fitness in the part II article.

To Your Success and Happiness,

Yong Hui