CareShield Life has officially launched on 1st Oct 2020.

If you are a Singaporean or PR who is between 30-40 this year, chances are you would have received a welcome letter to CareShield Life recently. This is because you are in the first cohort to be enrolled on this new compulsory national insurance scheme.

What exactly is CareShield Life?

CareShield Life is a national long-term care insurance scheme to help Singaporeans and PRs cope with the costs of severe disability care.

What is long term care and why is it important to me?

According to the Ministry of Health, 1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime.

And about 3 in 10 will live a decade or more after becoming severely disabled.

Severe disability can result from a sudden event, like a stroke or serious accident. It could also be caused by progressive worsening or complications of chronic illnesses such as diabetes, or physical weakness due to ageing.

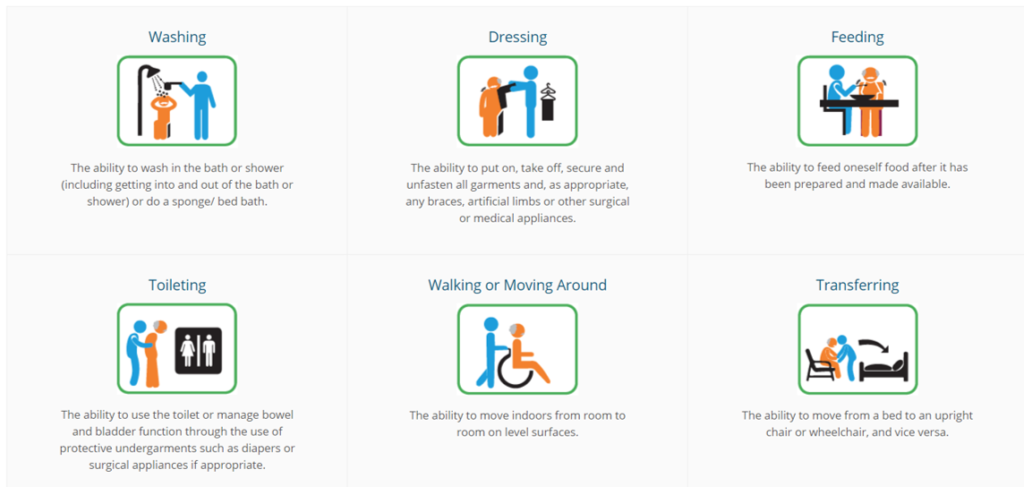

Severe disability refers to the inability to perform at least 3 of the 6 Activities of Daily Living (ADL) below:

If you think about it, these are the essential common activities we need to be able to do before we can even get out of the house each morning.

In the event of severe disability, I can only imagine how challenging it will be physically, emotionally and financially on oneself and the loved ones. There is definitely a need for long term care in terms of getting a trained helper, nurse or even nursing care services.

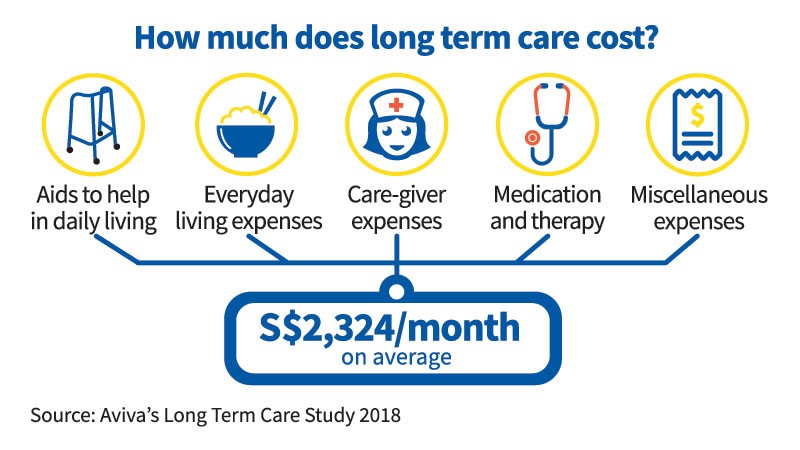

And long term care can be very expensive.

An additional cost of $2,324 every month can become a heavy financial burden on the family and on one’s self over time.

That’s why long term care financing is something crucial to plan for. CareShield Life serves as an insurance to help mitigate some of the costs.

How can CareShield Life help?

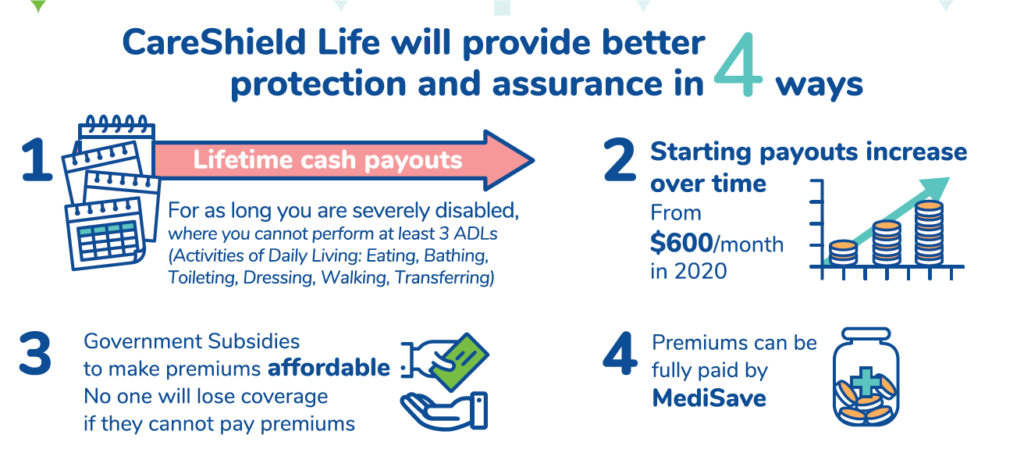

CareShield Life will provide a lifetime cash payout to help cover some of the costs of long term care in the event of one’s inability to perform 3 out of 6 of the ADLs.

The cash payout starts from $600/mth and will increase over time.

Yes, you may notice the $600/mth is insufficient to meet the average costs of long term care. But well, at least it provides some basic support for the majority of Singaporeans and PRs.

Those who wish to receive higher monthly payouts can get Supplements from private insurers and it’s possible to do so using Medisave (up to a withdrawal limit of $600/yr).

Good thing is that as CareShield Life will provide universal coverage for all, meaning those with pre-existing conditions and disabilities will also be covered.

How about the premiums?

Depending on your age in 2020, you can expect to pay between $206 to $366 a year for CareShield Life. As this is a national scheme, all premiums will be fully paid by Medisave and the government will also provide transitional and means-tested subsidies to make the premiums affordable.

To calculate your premium, you can check out the online premium calculator here https://www.moh.gov.sg/careshieldlife/about-careshield-life/careshield-life-premium-calculator

How different is CareShield Life from MediShield Life?

Many people ask me – “Yonghui, one CareShield, one Medishield, what’s the difference huh?”

Both CareShield Life and MediShield Life are both compulsory national insurance schemes to provide lifetime financial protection for Singaporeans and PRs. And both are payable using your Medisave.

The difference is in the purpose of the plans.

MediShield Life is an universal health insurance scheme meant to cover hospital bills and certain costly outpatient treatment, while CareShield Life is to cover the costs of long term care.

MediShield Life reimburses the costs of one’s medical expenses while CareShield Life pays a monthly cash payout to cope with the care giving costs. Both plans complement each other to provide a basic financial safety net in the event of one’s serious illness or severe disability.

What do I need to do to get covered?

Your CareShield Life policy will automatically commence once you receive the welcome letter and no action is required.

Most people would have received a CareShield Life welcome package by 2 September 2020 or up to two months before their 30th birthday, whichever is later.

So there you have it, the essentials of what you need to know about CareShield Life in a nutshell.

What if I am already above 40 this year? Will CareShield Life affect me? (to find out more, click here)

Meanwhile if you have any burning questions about CareShield Life, feel free to drop me a note here

To Your Success and Happiness,

Yong Hui